The first step to improvement in anything is to understand where you might be failing. If that sounds like a negative approach it is intended not to depress you but to highlight the areas in which you might have improvement opportunities. Before you can fix any problem, you need to be aware that the problem exists.

In the context of Enterprise Sales, in truth there are ever only two reasons why you lose a deal. Either:

- You shouldn’t have been there in the first place, or

- You were outsold.

There are no other reasons.

When you learn late in the sale cycle or after the deal is lost that the prospective customer has a problem you can’t solve, or does not really have a project, or an incumbent supplier wrote the Request for Proposal (RFP), you know that you should never have applied your valuable sales resources to pursue the opportunity in the first place. This is where rigorous opportunity qualification matters.

If a real opportunity actually existed for which you have a viable solution to solve the customer’s problem, but you did not win, then you were outsold. It is as simple as that. Some competitor did a better job of connecting their solution to the customer’s business problem to win the deal, in which case the competitor outsold you.

Alternatively, when you lose to ‘No Decision’ it is because the customer perceives that they should not proceed, or should embark on an alternative project, solving a different business problem. Then the customer’s organization outsold you. Your proposition was too weak to cause the customer to act or the alternative value proposition from inside the customer’s business was stronger than yours.

How Do You Know You Have a Sales Problem?

Mapping the common symptoms of ineffective sales execution or management to the different levels of customer impact makes it easier to see the competencies that need to be improved. Discovering the root cause is less obvious, so it is better to start with the symptoms. This provides a clear path to increased sales effectiveness, mapped to the complexity of the sales engagement (and the customer impact).

It is much easier to immediately observe the evidence, or symptoms, of a sales problem than it is to understand the underlying cause. For example, if a seller consistently loses to competition, it is patently obvious. The data shows you lost to a competitor and you don’t need to interpret the data. On the other hand, it is not immediately obvious that the reason why there are frequent competitive losses may be because of a struggle to position the (competitive / unique) value of the solution in front of a customer. You can’t know that unless you join the seller on the sales call, and that’s just not a scalable solution in today’s fast-moving world.

In a previous post I segmented sales engagement into three levels of complexity. Different problems, or reasons for failure, exist in each. In fact they build on each other.

I think the levels are pretty simple to understand and can be deduced by looking at the crossover between how the customer wants to buy and the opportunity for the seller.

At Level 1; if the customer purchases your product it is not going to fundamentally change their business; the impact is fairly low and correspondingly the revenue opportunity relating to this transient sales engagement is typically less than $50,000.

At Level 2, the impact on the customer of deploying a solution is increased over the previous level. The buying process is probably formal and the number of people in the buying committee has grown.

The revenue opportunity has grown correspondingly and is now probably greater than $50,000.

At Level 3, the impact on the customer is high. The buying process is almost certainly formal and the number of people in the buying committee will have grown again. The revenue opportunity has grown significantly and should exceed $250,000. The customer is looking for a partner to develop a vision with them so the desired relationship level is Trusted Advisor, where your engagement is almost continuous. This requires material investment of time and resource from your company and you definitely need a strategic approach with this customer.

Bad Things That Happen

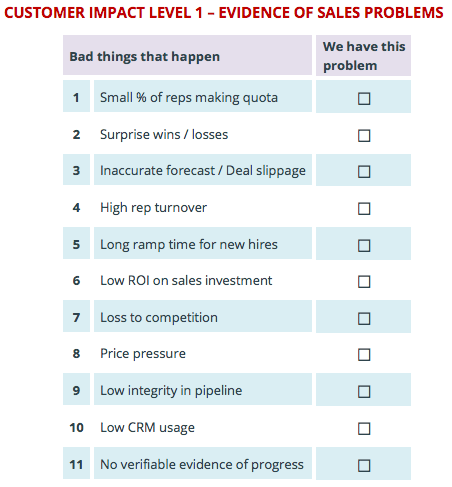

In this post, I will describe the symptoms that you should look out for in a Level 1 sales engagement. When you examine the list of ‘Bad things that happen,’ you should bring the model to life for yourself. Think whether you see these ‘bad things’ in your sales organization and tick the appropriate box / boxes in the table below.

There is unfortunately no end to the list of bad things that can happen in a sales environment. The list above is not exhaustive, and so far we are only at Customer Impact Level 1. There are many more bad things yet to come in the other levels – it’s always good to know what to look for.

There is unfortunately no end to the list of bad things that can happen in a sales environment. The list above is not exhaustive, and so far we are only at Customer Impact Level 1. There are many more bad things yet to come in the other levels – it’s always good to know what to look for.

If you’ve not (at least mentally) gone through the list and checked off the items in the “We have this problem”, take the time to do it now. It will make the next part more meaningful.

Ready?

Yes?

OK, let’s move on.

In the next table I have mapped the evidence points above to the likely primary root causes – I call them Obstacles. Of course in many cases, each obstacle could be applied to most of the ‘Bad things that happen’ list. For example, if a small percentage of your reps are making quota (#1 above), then you could argue that every obstacle contributes to that, and to an extent that is true. But I am trying to guide you to focus on the Obstacles that contribute most directly to the things you want to fix. If we don’t allocate the primary causes we lose focus on what improvements we should prioritize.

You can see at glance that some of the Obstacles cause many bad things to happen. For example, if you have poor knowledge of the customer’s buying process it is really hard to know whether you are focused on the right things. You can’t possibly know when the deal will close – so your sales forecasts will likely be a bit of a guessing game. And, you probably can’t really tell whether this is a real opportunity, so the value recorded in your pipeline management system is probably overstated.

The mere fact that there are more entries in the relevant Bad Things column for a particular obstacle doesn’t necessarily mean you need to prioritize that obstacle. You need to examine the evidence in the first table to see where you have evidence of problems.

If all your sales problems are covered in the Level 1 list, you can quickly move to putting initiatives in place to solve these problems. But because life (or the world of a salesperson) is not linear, nor fits neatly into a box, I would recommend taking a look at the other symptoms of sales problems in the follow up posts with respect to Level 2 and Level 3 problems. Perhaps some of the bad things described at those levels will give you food for thought too!

There is not space in this post to prescribe all of the answers, but in my experience, much of these problems can be mitigated with a well-executed sales process. Figuring out how to design a sales process, mapped to the customer’s buying process, and implementing a framework for accelerated sales velocity, consistent visibility and management is my number one recommendation.

I describe this more fully in my book Digital Sales Transformation in a Customer First World.

You can read more in my book, or subscribe to the blog for future posts.

If you want to read more of my blogs please subscribe to Think for a Living blog. Follow me on Twitter or connect on LinkedIn. I want you to agree or disagree with me, but most of all: I want you to bring passion to the conversation.

Donal Daly is Executive Chairman of Altify having founded the company in 2005. He is author of numerous books and ebooks including the latest Amazon #1 Bestseller Digital Sales Transformation in a Customer First World (Nov 3, 2017) and his previous Amazon #1 Best-sellers Account Planning in Salesforce and Tomorrow | Today: How AI Impacts How We Work, Live, and Think. Altify is Donal’s fifth global business enterprise.