I’m generally not one to give investment advice. Stock markets are notoriously hard to predict and, in my opinion, you should never invest money you are not prepared to lose. However, I have found a predictor of success on which I am prepared to bet some hard earned dollars.

When I invest my personal money, I only do so; if I understand the market well (for me that usually means technology), I like the product offering, and I know enough about the track record, ambition and plans of the leadership team. If the market opportunity is strong, and the value proposition of the product is compelling, then the performance of the company is usually driven by the quality of the team. You need all three to outperform the financial markets.

The realization I have come to is a confluence of two different journeys I have taken. From a personal point of view, I am a moderate medium-risk investor in stocks. From a professional point of view, I am always looking to define real hard metrics on the value that companies gain when they embark on a sales transformation journey. An investment in sales transformation is usually an indicator of a well run company and the returns I’ve seen substantiate that. Most of the investments I choose to make are in companies who are customers of Altify – and that strategy has been rewarding.

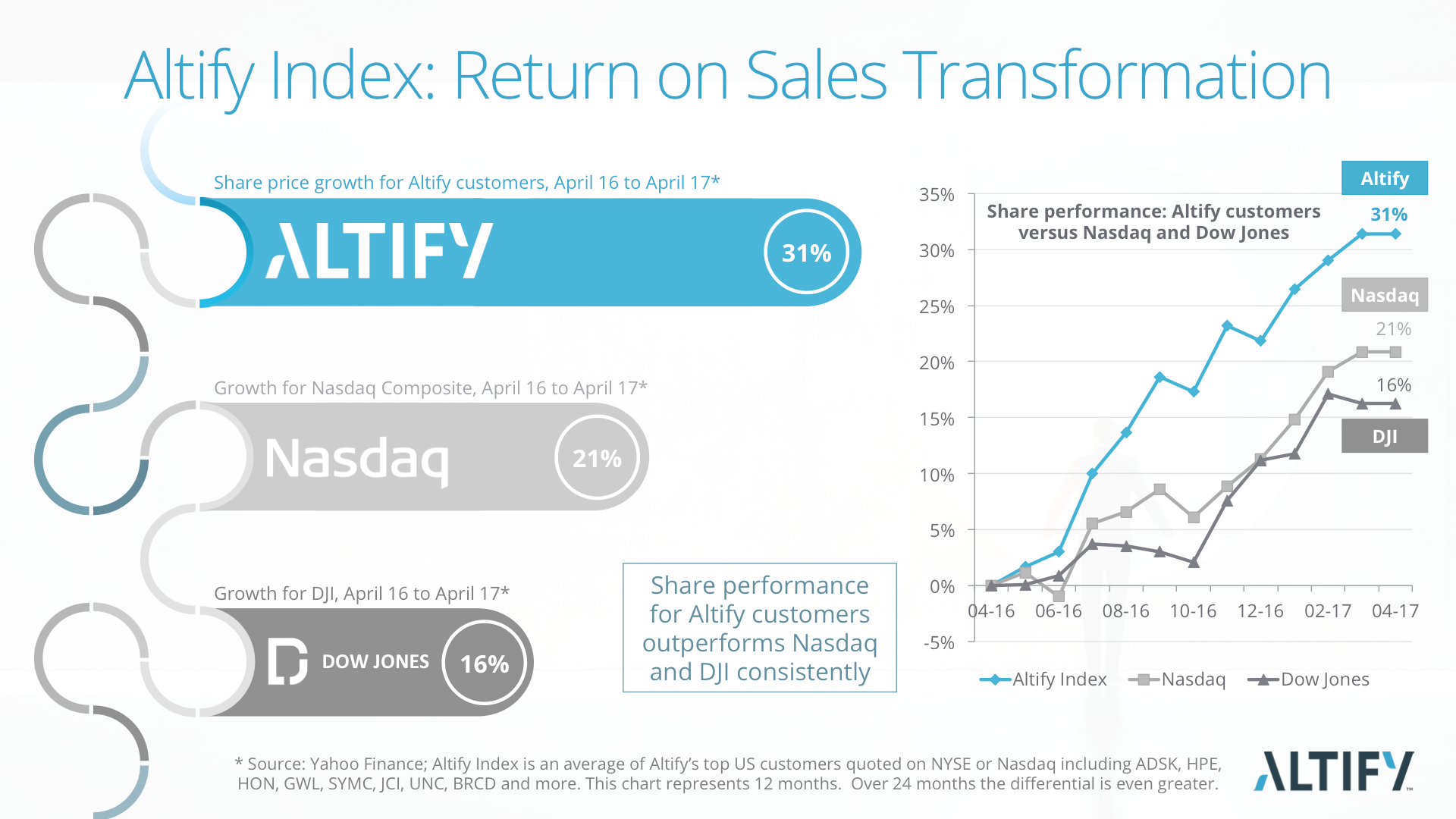

You can see from the following chart that, over the last 12 months, the share price performance of Altify’s customers has outperformed growth in the Nasdaq Composite by 50 percent, and the Dow Jones Industrial Average by 93 percent.

Measuring return on investment in Sales Transformation is something we take very seriously at Altify, and it was one of the reasons I founded the company in 2005. Before that, because there was little technology applied, it was hard to measure the adoption of the methodology, it was hard for sellers to remember what they learned in the classroom, and it was almost impossible to measure the return on investment. If you read the Business Performance Benchmark Study, you will have seen that the quantifiable benefit of deploying sales best practices. At the end of the day these behaviors contribute to overall company performance, so it is extremely gratifying to see our customers being rewarded by their shareholders for their sales transformation investments.

Measuring return on investment in Sales Transformation is something we take very seriously at Altify, and it was one of the reasons I founded the company in 2005. Before that, because there was little technology applied, it was hard to measure the adoption of the methodology, it was hard for sellers to remember what they learned in the classroom, and it was almost impossible to measure the return on investment. If you read the Business Performance Benchmark Study, you will have seen that the quantifiable benefit of deploying sales best practices. At the end of the day these behaviors contribute to overall company performance, so it is extremely gratifying to see our customers being rewarded by their shareholders for their sales transformation investments.

Over the years I have personally seen some stellar returns from investing in our customers who invest with us. Salesforce, HPE and Autodesk spring to mind. The good news is that the returns seem to sustain. As you can see here the Altify Index for the last 12 months shows an average growth in share price of 31%, against 20% for Nasdaq and 16% for DJI. Over the two year period the differential is even greater: Altify Index is +34%, while Nasdaq and DJI remain at +20% and +16% respectively.

Please don’t take this as investment advice. I am not qualified to give that guidance in that area. Before I invest, I get the opportunity to get to know the company’s leadership (through vehicles like our Customer Advisory Board) and can blend that knowledge with what I know about the market to make an informed investment decision. You may not always have the opportunity to gain that level of insight. However, what I do know, and you can learn from the Business Performance Benchmark Study is that sales transformation works when operationalized in software and embedded as part of how a company does business. This seems to me to be as good an investment strategy to follow as any.

If you want to read more of my blogs please Subscribe to Think for a Living.

Follow me on Twitter or connect on LinkedIn. I want you to agree or disagree with me, but most of all: I want you to bring passion to the conversation.

Donal Daly is Executive Chairman of Altify having founded the company in 2005. He is author of numerous books and ebooks including the Amazon #1 Best-sellers Account Planning in Salesforce and Tomorrow | Today: How AI Impacts How We Work, Live, and Think. Altify is Donal’s fifth global business enterprise.